Begin overlay.

* TERMS AND CONDITIONS

Preferred Seat Selection Within 48 Hours Prior to Departure: When available, primary Cardmembers with a Southwest Rapid Rewards® Premier Credit Card or a Southwest Rapid Rewards® Premier Business Credit Card will be able to select a Preferred or a Standard seat within 48 hours prior to a flight’s scheduled local departure time. If no Preferred or Standard seat is available, Cardmembers will be assigned a seat in accordance with the fare rules of the ticket purchased. When available, Cardmembers will be able to select Preferred or Standard seats for up to 8 additional Passengers on the same reservation as the Cardmember, allowing for a total of 9 Preferred or Standard seats. If the Cardmember is removed from the reservation and there is no primary Cardmember or tier Rapid Rewards® Member with the same or greater seating benefits, all seating selections for that reservation will be released and seats will be assigned in accordance with the fare rules of the ticket purchased. Benefits may not apply on itineraries booked with partner airlines. Cardmembers should allow up to 14 days for card status to be updated in their Rapid Rewards account to be eligible for this benefit. Authorized users of a Rapid Rewards Premier Credit Card and employee cards of a Rapid Rewards Premier Business Credit Card are not eligible for this benefit. Credit card account must be open and not in default when selecting a Preferred or Standard seat. If your Credit card account is closed or in default before or at the time of travel, the seat selection will be released. Chase is not responsible for the provision of or failure to provide the stated benefits and services.

First Checked Bag Free: The primary Rapid Rewards® Credit Cardmember and up to eight Passengers traveling on the same reservation are each eligible to receive their first standard checked bag free. Cardmembers should allow up to 14 days for card status to be updated in their Rapid Rewards account to be eligible for this benefit. To receive their first standard checked bag free, the primary Cardmember must include their Rapid Rewards number in their reservation. The first standard checked bag free is not available on flights booked with a partner carrier. Service charges for oversized, overweight, and extra baggage may apply. Cardmembers with A-List Preferred or A-List status or who purchase a Business Select® fare will receive the bag benefits associated with their Southwest Rapid Rewards® tier status or fare. Cardmembers who are already exempt from paying the charge for their first checked bag are not eligible for this benefit. Authorized users of Rapid Reward Credit Cards and employee cards of Rapid Rewards Business Credit Cards are not eligible for this benefit. Credit card account must be open and not in default to be eligible for this benefit. Chase is not responsible for the provision of or failure to provide the stated benefits and services.

Group 5 Boarding Benefit: Primary Cardmembers with a Southwest Rapid Rewards® Credit Card or Southwest Rapid Rewards® Business Credit Card will be able to board their Southwest® flight with Group 5. Up to 8 Passengers traveling on the same reservation as the Cardmember will be able to board with Group 5 as long as the Cardmember remains booked on the same reservation. Eligible Passengers will have “Cardmember” displayed on their Southwest® boarding pass to indicate their boarding privilege. If the Cardmember’s account is closed or in default before or at the time of travel, this benefit will be canceled for them and all Passengers on the same reservation. If the Cardmember is removed from the reservation and there is no primary Cardmember or tier Rapid Rewards member with the same or greater boarding benefits, boarding will be assigned in accordance with the fare rules of the ticket purchased. Cardmembers should allow up to 14 days from approval for card status to be updated in their Rapid Rewards® account to be eligible for this benefit. Authorized users of Rapid Rewards Credit Cards and employee cards of Rapid Rewards Business Credit Cards are not eligible for this benefit. This benefit is available on Southwest Airlines® operated flights only. Benefits may not apply on itineraries booked with partner airlines. Chase is not responsible for the provision of or failure to provide the stated benefits and services.

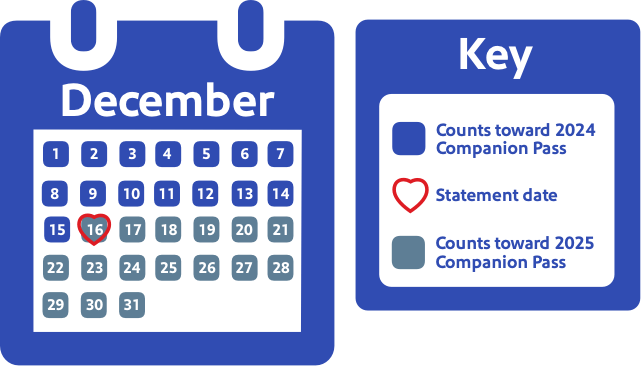

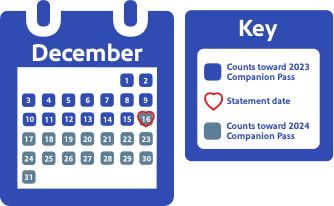

Earning in the Rewards Program: You’ll earn points on purchases of products and services, minus returns or refunds, made with a Rapid Rewards® Credit Card by you or an authorized user of the account; however, the following types of transactions won’t count as purchases and won’t earn points: balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 3 points: You’ll earn 3 points for each $1 spent on purchases made directly with Southwest Airlines®, including flight, inflight, Southwest® gift cards, and Getaways by SouthwestTM packages. Other Southwest Airlines related purchases, such as Southwest Cruises, Southwest Charters, and Southwest Cargo® are excluded. 2 points: You’ll earn 2 points for each $1 of the first $8,000 spent each account anniversary year on combined purchases in the following rewards categories: gas stations and dining at restaurants. After $8,000 is spent, you go back to earning 1 point for each $1 spent, with no maximum. 1 point: You’ll earn 1 point for each $1 spent on all other purchases. 1 point on balance transfers: You’ll earn 1 point for each $1 of the first $15,000 of balance transfers made during the first 90 days from your original account open date. 6,000 bonus points each account anniversary year: You’ll receive 6,000 bonus points each account anniversary year. “Account anniversary year” means the year beginning with your account open date through the first statement after the anniversary of your account open date, and each 12 billing cycles after that. 2,000 tier qualifying points: You’ll earn 2,000 tier qualifying points (TQPs) for each $5,000 spent in purchases annually. TQPs can be used to count toward qualification for Rapid Rewards A-List or A-List Preferred status. “Annually” means the year beginning with your account open date through the first December statement cycle date of that same year, and the 12 billing cycles starting after your December statement cycle date through the following December statement cycle date each year. Information about earning/transferring points to Southwest Airlines®: Points earned during a billing cycle will be automatically transferred to Southwest Airlines after the end of each billing cycle. Losing points: You’ll immediately lose all points that haven’t been transferred to Southwest Airlines if your card account status changes, or your card account is closed for program misuse, fraudulent activities, or other reasons described in the terms of the Rewards Program Agreement. For important information about Chase rewards categories, see opens in a new windowchase.com/RewardsCategoryFAQs. For more information about the Rapid Rewards Premier Business Credit Card rewards program, you can see the latest Rewards Program Agreement at opens in a new window chase.com/swapremierbizcard/rewardsagreement and it will also be available for Cardmembers after logging in to opens in a new windowchase.com and will be mailed for new or changed accounts.

Companion Pass Qualifying Points: Companion Pass® qualifying points are earned from revenue flights booked through Southwest®, points earned on Rapid Rewards® Credit Cards, and base points earned from Rapid Rewards partners. The following do not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards®, Valued Opinions, and Diners Club®; points earned from Rapid Rewards program enrollment, tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards account. Only points posted on your billing statements and posted to your Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. For example, if you make a purchase after your December billing statement cycle date, the points on those purchases will not count toward Companion Pass status in the year the purchase was made; they will appear on your January billing statement and post to your Rapid Rewards account in January. Companion Pass Qualifying Points Boost: As a Southwest Rapid Rewards Cardmember, you will earn one boost of 10,000 Companion Pass qualifying points each calendar year. The boost will be deposited into your eligible Rapid Rewards account by January 31st each calendar year or up to 30 days after account opening. To receive Companion Pass qualifying points boost your credit card account must be open and not in default at the time of fulfillment. Only one credit card account per Southwest Rapid Rewards Member (Rapid Rewards Member must be the primary Cardmember on that account), is eligible for one boost of 10,000 Companion Pass qualifying points per calendar year. JPMorgan Chase Bank, N.A. is not responsible for the provision of, or failure to provide, the stated benefits and services.

Southwest® 15% Promotion Code: Cardmembers with a Southwest Rapid Rewards® Premier Credit Card or Southwest Rapid Rewards® Premier Business Credit Card will receive one 15% promotion code each account anniversary year. “Account anniversary year” means the year beginning with your account open date through the first statement after the anniversary of your account open date, and each 12 billing cycles after that. The 15% promotion code will appear in your Rapid Rewards® account within 15 days of account anniversary. The promotion code will be valid within one year of delivery, the exact date of which will be listed in your Rapid Rewards® account. The 15% promotion code savings is not valid on Basic fare bookings. Promotion code must be entered in the Promo Code box and will be applied to the base fare before government taxes and fees. Please note that the Department of Transportation (DOT) requires advertised fares to include all government taxes and fees, however this promotion code savings applies to the base fare only. All flights are subject to taxes, fees, and other government or airport-imposed charges of at least $5.60 per one-way trip. Applicable taxes, fees, and other government or airport-imposed charges can vary significantly based on your arrival and departure destination. The payment of any taxes, fees, and other government or airport-imposed charges is the responsibility of the Passenger and must be paid at the time travel is booked with a credit card, flight credit, or Southwest gift card. Fares are subject to change until ticketed. The promotion code is not redeemable for cash and may not be used in conjunction with other promotion codes, special offers, or toward the purchase of a gift card or previously booked flight, or change to a previously booked flight. The promotion code is only valid on Southwest.com and Southwest app and is not valid on group travel or Southwest Vacations®, Getaways by SouthwestTM, fares booked via opens overlayswabiz.com, our Southwest Partner Services API or through Global Distribution Systems, or special fares, such as military and government fares. Credit card account must be open and not in default at the time of fulfillment. Chase is not responsible for the provision of, or failure to provide, the stated benefits and services.

25% back on inflight purchases on Southwest Airlines® flights: You will receive 25% back on Southwest Airlines inflight purchases made with your Southwest Rapid Rewards® Premier Business Credit Card for drinks and WiFi in the form of a credit card account statement credit. Statement credit(s) will post to your credit card account the same day as your purchase(s) and will appear on your monthly credit card billing statement within 6-8 weeks. You will also receive 25% back on inflight purchases made by employees on your account. To qualify for the 25% back, purchase must be made with your Southwest Rapid Rewards® Premier Business Credit Card and your account must be open and not in default at the time of fulfillment.

No Foreign Transaction Fees: See Cardmember Agreement for details.

Complimentary DashPass: When the membership is activated for the first time with a Southwest Rapid Rewards® Premier Business Credit Card between 02/01/2025 and 12/31/2027, you will receive 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date. After the complimentary DashPass membership period ends, you will continue to be enrolled and will be automatically charged the then-current monthly DashPass rate (plus applicable tax) on a recurring monthly basis for each membership activated until you cancel. You can cancel anytime on DoorDash or Caviar. The same log in credentials must be used on DoorDash and Caviar in order for the DashPass benefit to be used on both applications. To receive the membership benefits, the cardmember must first add their applicable Chase credit card as a default payment method on DoorDash or Caviar, and then click the activation button. Once enrolled in DashPass, you must use your Southwest Rapid Rewards® Premier Business Credit Card for payment at checkout for DashPass-eligible orders to receive DashPass benefits. DashPass benefits apply only to eligible orders from DashPass-eligible merchants that meet the minimum subtotal requirement (as stated in the DoorDash and Caviar apps and sites with amounts subject to change). However, other fees (including service fee), taxes, and gratuity on orders may apply. Current value of the DashPass membership is as of 02/01/2025. DashPass orders are subject to delivery driver and geographic availability. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. If you product change to another Chase credit card during the promotional period, your benefits may change. You may experience a delay in updating your applicable benefits on DoorDash or Caviar; please note, once you product trade, the benefits from your previous credit card are no longer available for your use. You can only access the benefits available with your current credit card. Mobile applications, websites and other information provided by DoorDash or Caviar are not within Chase’s control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, DoorDash or Caviar benefits and services. Your applicable Chase credit card account must be open and not in default to maintain membership benefits. See full DoorDash terms and conditions at: opens overlayhttps://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US.

Earn Up to $10 Off Quarterly on DoorDash Non-Restaurant Orders: Once you have activated your Southwest Rapid Rewards® Premier Business Credit Card DashPass membership, you will receive a $10 off discount each calendar quarter at checkout on one qualifying non-restaurant order on DoorDash as long as you remain enrolled in a DashPass membership. Discount applies to subtotal only; does not apply to fees, taxes, and gratuity. Fees, taxes, and gratuity still apply. To claim, select the discount from the promotion wallet at checkout, or claim the discount when prompted in the DoorDash app or website. If the full $10 value is not used on a single order, the remaining value will be forfeited. You must use the card used to enroll in your Southwest Rapid Rewards® Premier Business Credit Card DashPass membership as your payment method at order checkout to receive this discount. This discount may be combined with other order-level promotions, discounts, or deals. The quarterly discount will be made available to you in your DoorDash account at the beginning of each quarter and will only be available on that platform for the remainder of that calendar quarter; the quarterly discount will not roll over into a subsequent quarter. Once redeemed, the discount will not be refunded to the user regardless of whether the user otherwise receives a refund or credits back on their order. Not valid for the purchase of gift cards. Not valid on alcohol in some states. Limit one redemption per quarter per person. Valid in the U.S. only. Discount has no cash value and is non-transferable. Chase is not responsible for the provision of, or the failure to provide, DoorDash benefits and services. Credit card product changes during the promotional period will forfeit this offer. Additional DoorDash promotional terms and conditions available at: opens overlayhttps://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US.

All deliveries subject to availability. Must have or create a valid DoorDash account. Qualifying orders containing alcohol will be charged a $0.01 Delivery Fee. No cash value. Non-transferable. See full terms and conditions at: opens overlayhelp.doordash.com/consumers/s/article/offer-terms-conditions.

Three (3) Months of Complimentary Instacart+ Membership: You will receive one complimentary Instacart+ membership per eligible card account for three (3) months when the membership is activated on opens overlayhttps://www.instacart.com/p/chase-cobrands for the first time with your Southwest Rapid Rewards® Premier Business Credit Card between 5/1/2025 and 12/31/2027. (“You and “your” mean you as the primary cardmember or any authorized user, depending on which user activates first.) This offer is non-transferrable. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Wallet), or memberships purchased through third parties are excluded from this offer. Benefits of Instacart+ Membership include $0 delivery fees and reduced service fees. Other fees (including service fee), taxes, and gratuity on orders may apply. Delivery subject to availability. If you do not currently have a paid or trial Instacart+ membership, by activating your Instacart+ membership, you agree to the Instacart+ Terms and you agree that after the complimentary Instacart+ membership period ends, you will be automatically enrolled in an annual Instacart+ membership and billed at $99/year or the then current annual Instacart+ membership rate for each membership activated, billed automatically to any active card on file, unless you cancel during your complimentary Instacart+ membership period. You may cancel your paid subscription by selecting “Cancel Membership” on the “Your Instacart+ Membership” page. You will receive a refund if you cancel within 5 days of the start of the paid membership term and you have not placed any orders with Instacart+ nor activated the New York Times Cooking subscription offer.

If you currently have a paid Instacart+ membership, you agree that your existing membership will be paused for the duration of this benefit and resume upon expiration. Unless auto renew is turned off or not selected, your existing membership will automatically renew based on the Instacart+ Terms previously agreed upon unless you cancel. Your membership fees of $99/year or $9.99/month, depending on which plan you are enrolled in, will be billed to any active payment method on file until you cancel. You can cancel your Instacart+ membership prior to the end of your complimentary Instacart+ membership period or at any time thereafter. You may cancel your paid subscription by selecting “Cancel Membership” on the “Your Instacart+ Membership” page. You will receive a refund if you cancel within 5 days of the start of the paid membership term and you have not placed any orders with Instacart+ nor activated the New York Times Cooking subscription offer. If you have a trial Instacart+ membership, you agree that your complimentary 3-month membership will commence after the conclusion of your trial Instacart+ membership and you agree to the Instacart+ Terms, and you authorize a charge of $99/year, for an annual membership, to be billed automatically to any active card on file after your complimentary 3-month membership ends. Your membership will automatically renew every year to any active payment method you have on file until you cancel. Subscription prices are subject to change.

If you change to another Chase credit card during the promotional period, your benefits may change. Mobile applications, websites and other information provided by Instacart are not within Chase’s control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Your complimentary membership benefits may be removed if your eligible credit card account is closed or in default. Instacart is not a retailer or seller.

Receive one $10 credit per month in the Instacart App:As a Southwest Rapid Rewards® Premier Business Credit Card Primary cardmember, you can receive one $10 credit in your Instacart account each month you have an active Instacart+ membership after you activate your complimentary Chase Instacart+ membership using your eligible Chase credit card on opens overlayhttps://www.instacart.com/p/chase-cobrands from 5/1/2025 through 12/31/2027. The monthly credit will be made available to you in your Instacart+ account at the beginning of each month and will only be available on that platform for the remainder of that calendar month; the monthly credit will not roll over into a subsequent month. Each monthly credit is only eligible on one purchase of $10 or more made on Instacart.com with one retailer using your Southwest Rapid Rewards® Premier Business Credit Card. Any unused portion of a monthly credit will not be available for future use. Eligible purchases will qualify for this credit the month your Southwest Rapid Rewards® Premier Business Credit Card is added to your Instacart account and each month thereafter. To qualify for this credit, your Southwest Rapid Rewards® Premier Business Credit Card must be open and not in default at the time of fulfillment. If your credit card account is closed at any time, Instacart and Chase reserve the right to remove any unused Instacart credits from your account. Credit will be applied to the total purchase price for all eligible products and excludes taxes, service and delivery fees, tips, special handling fees and/or other fees. Limit 1 credit per order. Excludes restaurant orders powered by Uber Eats. State and Local laws in your area may prohibit alcohol discounts and/or exclude alcohol from this offer’s qualifying minimum spend of $10. If the discount isn’t applied automatically during checkout, alcohol products may not be eligible for this offer in your location. Credit has no cash value and is non-transferable. Mobile applications, websites and other information provided by Instacart are not within Chase’s control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Credit card product changes during the promotional period will forfeit this offer. Deliveries subject to availability. In order to take advantage of this offer, customers must have a valid account on Instacart.com with their valid Southwest Rapid Rewards® Premier Business Credit Card on file. Only one offer per household. Instacart reserves the right to modify or cancel this offer at any time. Offer may not be sold, copied, modified, transferred or used retroactively for prior purchases. Void where restricted or prohibited by law. Offer may expire prior to your actual use of the offer, without liability to Instacart. Instacart is not a retailer or seller. Instacart may not be available in all zip or post codes.

Priority Check-In and Security Lane Access: For a complete list of available Fly By® locations, visit opens overlaySouthwest.com/flyby.

Southwest® Same Day Upgrades for A-List and A-List Preferred: If there’s an open seat on a different flight that departs on the same calendar day as your original flight and it’s between the same cities, A-List and A-List Preferred Members can get a seat on the new flight free of airline charges. If there isn’t an open seat on this different flight, you can ask a Southwest Gate Agent to add you to the same-day standby list for a flight between the same city pairs that departs on the same calendar day prior to your originally scheduled flight, and you will receive a message if you are cleared on the flight. For both the same-day change and same-day standby benefits, you must change your flight or request to be added to the same-day standby list at least 10 minutes prior to the scheduled departure of your original flight or the no-show policy will apply. If using the app or mobile web for standby, you must list your name 30 minutes ahead of scheduled departure. Southwest Business Customers booked through travel agencies may need to see a Southwest agent at the airport for both a same-day change or standby listing. See opens overlaySouthwest.com/standby for more details. Based on the flight status contact preference selected during booking, the message regarding your standby status will be an email or text message with a link to access the boarding pass via the Southwest app, mobile web, or you can visit a Southwest Gate Agent to print off the boarding pass. If there are any government taxes and fees associated with these itinerary changes, you will be required to pay those but refunds will be provided. Your original boarding position is not guaranteed. Important: These benefits are available only by seeing a Southwest Gate Agent or calling 1-800-I-FLY-SWA®. If you change your flight through any other channel or to a flight that does not meet the requirements outlined above, you will be responsible for the difference in price. If an A-List or A-List Preferred Member is traveling on a multiple-Passenger reservation, same-day standby and same-day change will not be provided for non-A-List or non-A-List Preferred Members in the same reservation. For A-List and A-List Preferred Members who have also qualified for a Companion Pass®, A-List, and A-List Preferred benefits are not available to the Companion unless the Companion is also an A-List or A-List Preferred Member.

Redeem Southwest Rapid Rewards® Points With Pay Yourself Back®: Points may be redeemed for a statement credit using Pay Yourself Back for qualifying transactions made within the 90 days before the redemption request date. Categories and qualifying transaction eligibility may change from time to time without notice. Redemptions require a minimum of 1 Rapid Rewards Point. Chase has the right to change redemption values at any time. Statement credits will post to the card account within 7 business days of a request to redeem and will appear on the monthly Chase credit card billing statement within 1-2 billing cycles. Statement credits will reduce your balance but you are still required to make at least your minimum monthly payment. Chase reserves the right to determine which purchases qualify for a statement credit. Pay Yourself Back may be discontinued at any time.

No Blackout Dates And Unlimited Reward Seats: No blackout dates and unlimited reward seats apply to flights booked with points.

No Change Fees: Fare difference may apply.

Free live TV: Available only on WiFi-enabled aircraft. Limited-time offer. Where available. To view movies and select on-demand TV content, download the Southwest app from the Google Play Store or Apple App Store before your flight. Due to licensing restrictions, on WiFi-enabled international flights, free live TV and iHeartRadio may not be available for the full duration of flight.

Screens simulated for illustrative purposes only. Actual experience, options, merchants, and offers may vary.

INSTACART®, the Instacart Carrot logo, the Instacart Partial Carrot logo, and the Instacart Carrot Top logo are trademarks of Maplebear Inc., d/b/a Instacart. Instacart may not be available in all zip or post codes. See Instacart Terms of Service for more details.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.

SOUTHWEST RAPID REWARDS® PROGRAM INFORMATION

The Southwest Airlines Rapid Rewards Credit Card is brought to you by Southwest Airlines® and Chase. Southwest Airlines is responsible for the redemption of Rapid Rewards® points toward benefits and services. The number of points needed for a particular Southwest flight is set by Southwest and will vary depending on destination, time, day of travel, demand, point redemption rate, and other factors and is subject to change. Rapid Rewards points can only be transferred to the primary Cardmember’s Rapid Rewards account. All Rapid Rewards rules and regulations apply and can be found at opens overlaySouthwest.com/rrterms. Southwest reserves the right to amend, suspend, or change the program and/or program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points.

JPMorgan Chase Bank, N.A. Member FDIC

End overlay.