Begin overlay.

* TERMS AND CONDITIONS

Earning in the Rewards Program: See your Card Rewards Program Agreement for more details.

Tier Qualifying Points For Southwest Rapid Rewards Priority Credit Card: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines® or when you, or an authorized user or an employee, use the eligible Southwest Rapid Rewards® Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 2,500 TQPs for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on an eligible Southwest Rapid Rewards Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass® travel; Rapid Rewards partner points except for TQPs earned on the eligible Southwest Rapid Rewards Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest® or through the “More Rewards” site. Eligible credit cards: Southwest Rapid Rewards Priority Credit Card or Southwest Rapid Rewards Performance Business Credit Card.

Tier Qualifying Points For Southwest Rapid Rewards Premier Credit Card: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines® or when you or an authorized user use the eligible Southwest Rapid Rewards® Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 1,500 TQPs for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on an eligible Southwest Rapid Rewards Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass® travel; Rapid Rewards partner points except for TQPs earned on the eligible Southwest Rapid Rewards Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest® or through the “More Rewards” site. Eligible credit cards: Southwest Rapid Rewards Premier Credit Card.

Priority Check In And Security Lane Access: For a complete list of available Fly By® locations, visit opens overlaySouthwest.com/flyby.

Southwest® Same Day Upgrades for A-List and A-List Preferred: If there’s an open seat on a different flight that departs on the same calendar day as your original flight and it’s between the same cities, A-List and A-List Preferred Members can get a seat on the new flight free of airline charges. If there isn’t an open seat on this different flight, you can ask a Southwest Gate Agent to add you to the same-day standby list for a flight between the same city pairs that departs on the same calendar day prior to your originally scheduled flight, and you will receive a message if you are cleared on the flight. For both the same-day change and same-day standby benefits, you must change your flight or request to be added to the same-day standby list at least 10 minutes prior to the scheduled departure of your original flight or the no-show policy will apply. If using the app or mobile web for standby, you must list your name 30 minutes ahead of scheduled departure. Southwest Business Customers booked through travel agencies may need to see a Southwest agent at the airport for both a same-day change or standby listing. See opens overlaySouthwest.com/standby for more details. Based on the flight status contact preference selected during booking, the message regarding your standby status will be an email or text message with a link to access the boarding pass via the Southwest app, mobile web, or you can visit a Southwest Gate Agent to print off the boarding pass. If there are any government taxes and fees associated with these itinerary changes, you will be required to pay those but refunds will be provided. Your original boarding position is not guaranteed. Important: These benefits are available only by seeing a Southwest Gate Agent or calling 1-800-I-FLY-SWA®. If you change your flight through any other channel or to a flight that does not meet the requirements outlined above, you will be responsible for the difference in price. If an A-List or A-List Preferred Member is traveling on a multiple-Passenger reservation, same-day standby and same-day change will not be provided for non-A-List or non-A-List Preferred Members in the same reservation. For A-List and A-List Preferred Members who have also qualified for a Companion Pass®, A-List, and A-List Preferred benefits are not available to the Companion unless the Companion is also an A-List or A-List Preferred Member.

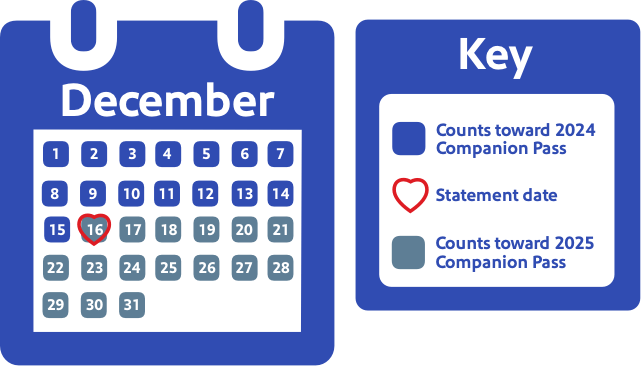

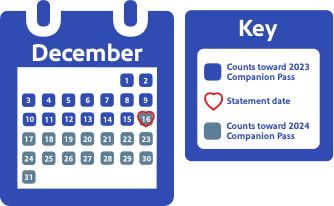

Companion Pass Qualifying Points: Companion Pass® qualifying points are earned from revenue flights booked through Southwest®, points earned on Rapid Rewards® Credit Cards, and base points earned from Rapid Rewards partners. The following do not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards®, Valued Opinions, and Diners Club®; points earned from Rapid Rewards program enrollment, tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards account. Only points posted on your billing statements and posted to your Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. For example, if you make a purchase after your December billing statement cycle date, the points on those purchases will not count toward Companion Pass status in the year the purchase was made; they will appear on your January billing statement and post to your Rapid Rewards account in January. Companion Pass Qualifying Points Boost: As a Southwest Rapid Rewards Cardmember, you will earn one boost of 10,000 Companion Pass qualifying points each calendar year. The boost will be deposited into your eligible Rapid Rewards account by January 31st each calendar year or up to 30 days after account opening. To receive Companion Pass qualifying points boost your credit card account must be open and not in default at the time of fulfillment. Only one credit card account per Southwest Rapid Rewards Member (Rapid Rewards Member must be the primary Cardmember on that account), is eligible for one boost of 10,000 Companion Pass qualifying points per calendar year. JPMorgan Chase Bank, N.A. is not responsible for the provision of, or failure to provide, the stated benefits and services.

Paying Bills Using A Credit Card: Please contact your service merchant for details on any fees that may be associated with paying your bill using a credit card.

Chase Mobile App: Chase Mobile® app is available for select mobile devices. Message and data rates may apply.

JPMorgan Chase Bank, N.A. Member FDIC

* TERMS AND CONDITIONS

Earning in the Rewards Program: See your Card Rewards Program Agreement for more details.

Tier Qualifying Points For Southwest Rapid Rewards Performance Business Credit Card: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines® or when you, or an authorized user or an employee, use the eligible Southwest Rapid Rewards® Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 2,500 TQPs for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on an eligible Southwest Rapid Rewards Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass® travel; Rapid Rewards partner points except for TQPs earned on the eligible Southwest Rapid Rewards Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest® or through the “More Rewards” site. Eligible credit cards: Southwest Rapid Rewards Priority Credit Card or Southwest Rapid Rewards Performance Business Credit Card.

Tier Qualifying Points For Southwest Rapid Rewards Premier Business Credit Card: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines® or when you or an employee use the eligible Southwest Rapid Rewards® Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 2,000 TQPs for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on an eligible Southwest Rapid Rewards Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass® travel; Rapid Rewards partner points except for TQPs earned on the eligible Southwest Rapid Rewards Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest® or through the “More Rewards” site. Eligible credit cards: Southwest Rapid Rewards Premier Business Credit Card.

Priority Check In And Security Lane Access: For a complete list of available Fly By® locations, visit opens overlaySouthwest.com/flyby.

Southwest® Same Day Upgrades for A-List and A-List Preferred: If there’s an open seat on a different flight that departs on the same calendar day as your original flight and it’s between the same cities, A-List and A-List Preferred Members can get a seat on the new flight free of airline charges. If there isn’t an open seat on this different flight, you can ask a Southwest Gate Agent to add you to the same-day standby list for a flight between the same city pairs that departs on the same calendar day prior to your originally scheduled flight, and you will receive a message if you are cleared on the flight. For both the same-day change and same-day standby benefits, you must change your flight or request to be added to the same-day standby list at least 10 minutes prior to the scheduled departure of your original flight or the no-show policy will apply. If using the app or mobile web for standby, you must list your name 30 minutes ahead of scheduled departure. Southwest Business Customers booked through travel agencies may need to see a Southwest agent at the airport for both a same-day change or standby listing. See opens overlaySouthwest.com/standby for more details. Based on the flight status contact preference selected during booking, the message regarding your standby status will be an email or text message with a link to access the boarding pass via the Southwest app, mobile web, or you can visit a Southwest Gate Agent to print off the boarding pass. If there are any government taxes and fees associated with these itinerary changes, you will be required to pay those but refunds will be provided. Your original boarding position is not guaranteed. Important: These benefits are available only by seeing a Southwest Gate Agent or calling 1-800-I-FLY-SWA®. If you change your flight through any other channel or to a flight that does not meet the requirements outlined above, you will be responsible for the difference in price. If an A-List or A-List Preferred Member is traveling on a multiple-Passenger reservation, same-day standby and same-day change will not be provided for non-A-List or non-A-List Preferred Members in the same reservation. For A-List and A-List Preferred Members who have also qualified for a Companion Pass®, A-List, and A-List Preferred benefits are not available to the Companion unless the Companion is also an A-List or A-List Preferred Member.

Companion Pass Qualifying Points: Companion Pass® qualifying points are earned from revenue flights booked through Southwest®, points earned on Rapid Rewards® Credit Cards, and base points earned from Rapid Rewards partners. The following do not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards®, Valued Opinions, and Diners Club®; points earned from Rapid Rewards program enrollment, tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards account. Only points posted on your billing statements and posted to your Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. For example, if you make a purchase after your December billing statement cycle date, the points on those purchases will not count toward Companion Pass status in the year the purchase was made; they will appear on your January billing statement and post to your Rapid Rewards account in January. Companion Pass Qualifying Points Boost: As a Southwest Rapid Rewards Cardmember, you will earn one boost of 10,000 Companion Pass qualifying points each calendar year. The boost will be deposited into your eligible Rapid Rewards account by January 31st each calendar year or up to 30 days after account opening. To receive Companion Pass qualifying points boost your credit card account must be open and not in default at the time of fulfillment. Only one credit card account per Southwest Rapid Rewards Member (Rapid Rewards Member must be the primary Cardmember on that account), is eligible for one boost of 10,000 Companion Pass qualifying points per calendar year. JPMorgan Chase Bank, N.A. is not responsible for the provision of, or failure to provide, the stated benefits and services.

Paying Bills Using A Credit Card: Please contact your service merchant for details on any fees that may be associated with paying your bill using a credit card.

Chase Mobile App: Chase Mobile® app is available for select mobile devices. Message and data rates may apply.

JPMorgan Chase Bank, N.A. Member FDIC

End overlay.